Swiggy, one of India’s largest food and grocery delivery platforms, is gearing up for a massive ₹10,000 crore Initial Public Offering (IPO), and this move is making waves across the financial and tech markets. With its IPO, Swiggy is positioning itself to raise significant funds and follow in the footsteps of its competitor, Zomato, which saw phenomenal success after its own IPO.

But with Swiggy still operating at a loss, the real question is: What makes Swiggy worth investing in now? To answer that, we’ll dive deep into Swiggy’s unique business model, competitive advantages, risks, and the opportunities this IPO presents to investors.

1. Swiggy’s Super App Model: A Key Differentiator

Swiggy’s core strength lies in its super app model, a major factor that sets it apart from competitors like Zomato and Blinkit. Rather than offering food delivery as a standalone product, Swiggy has expanded its app to provide multiple services under one roof. It offers grocery delivery through Instamart and package delivery via Swiggy Genie—all through the same app, infrastructure, and payment system.

1.1 Lower Customer Acquisition Costs

Swiggy’s integrated platform allows it to significantly reduce its customer acquisition costs (CAC). Once a user is on the Swiggy app for food delivery, they can easily be converted into Instamart or Genie users with minimal additional marketing. In contrast, Zomato operates separate apps for its various services (food, Blinkit, and Hyperpure), which means they need to invest in acquiring customers for each app separately. According to the DRHP, Swiggy’s CAC stands at around ₹400-₹500, compared to Zomato’s ₹500-₹600 per user.

1.2 Higher User Engagement

Swiggy’s super app model fosters higher user engagement by offering a variety of services that encourage users to spend more time on the platform. A user might open the app for a food order but also decide to buy groceries from Instamart or send a parcel via Genie in the same session. This increased engagement strengthens Swiggy’s brand loyalty.

1.3 Shared Infrastructure and Operational Efficiency

By operating multiple services on the same platform, Swiggy can streamline its operations and save on infrastructure costs. The shared logistics infrastructure is especially noteworthy. In many cases, a single delivery executive can deliver both a food order and a grocery order during one trip, improving operational efficiency by 20%. This not only lowers delivery costs but also allows Swiggy to scale its delivery network more effectively than competitors.

2. Competitive Landscape: Opportunities and Threats

While Swiggy’s model presents clear advantages, it also faces stiff competition and significant challenges. Zomato’s IPO success and market presence loom large, but Swiggy’s unique approach may help it carve out a larger share of the market.

2.1 Advantages Over Competitors

Swiggy’s super app model offers the advantage of cross-selling and upselling its services to the same customer base. As a result, Swiggy can more easily introduce new services like medicine or laundry delivery without creating a separate app or brand. Zomato, on the other hand, needs to establish each of its new services under different apps, requiring additional investment in customer acquisition.

Additionally, Swiggy’s hub-and-spoke delivery model allows for significant cost savings. If Swiggy can reduce delivery costs from the industry standard of ₹30 per order to ₹24, it could save an estimated ₹400 crores annually. This efficiency is vital in a competitive landscape where margins are razor-thin.

2.2 Disadvantages and Market Challenges

Despite the advantages, Swiggy’s super app model has yet to prove its dominance in India. Unlike China, where super apps like WeChat and Alipay thrive, Indian users have shown a preference for specialized apps—one app for messaging, another for payments, and yet another for shopping. This raises concerns about whether Swiggy can convince Indian consumers to use a single app for multiple services.

Moreover, Swiggy has been losing market share to Zomato. Zomato aggressively expanded into Tier 2 and Tier 3 cities early on, while Swiggy initially focused on metro areas, allowing Zomato to gain a foothold in smaller towns. Swiggy’s IPO might help them expand in these regions, but they are playing catch-up.

3. Swiggy’s Financials: Balancing Growth and Losses

Swiggy’s IPO aims to raise ₹10,000 crore, with ₹5,000 crore being used to fund growth through technology investments, cloud infrastructure, and marketing, while the rest will go towards giving existing investors an exit through Offer for Sale (OFS).

3.1 Revenue Growth and Reduced Losses

Swiggy’s revenue grew by 36% from ₹8,265 crore in FY23 to ₹11,247 crore in FY24, and its losses reduced by 44% from ₹4,276 crore to ₹2,250 crore over the same period. This shows significant improvement in its financial health, but it still lags behind Zomato, which turned profitable in FY24, achieving a positive EBITDA of ₹43 crore after years of operating in the red.

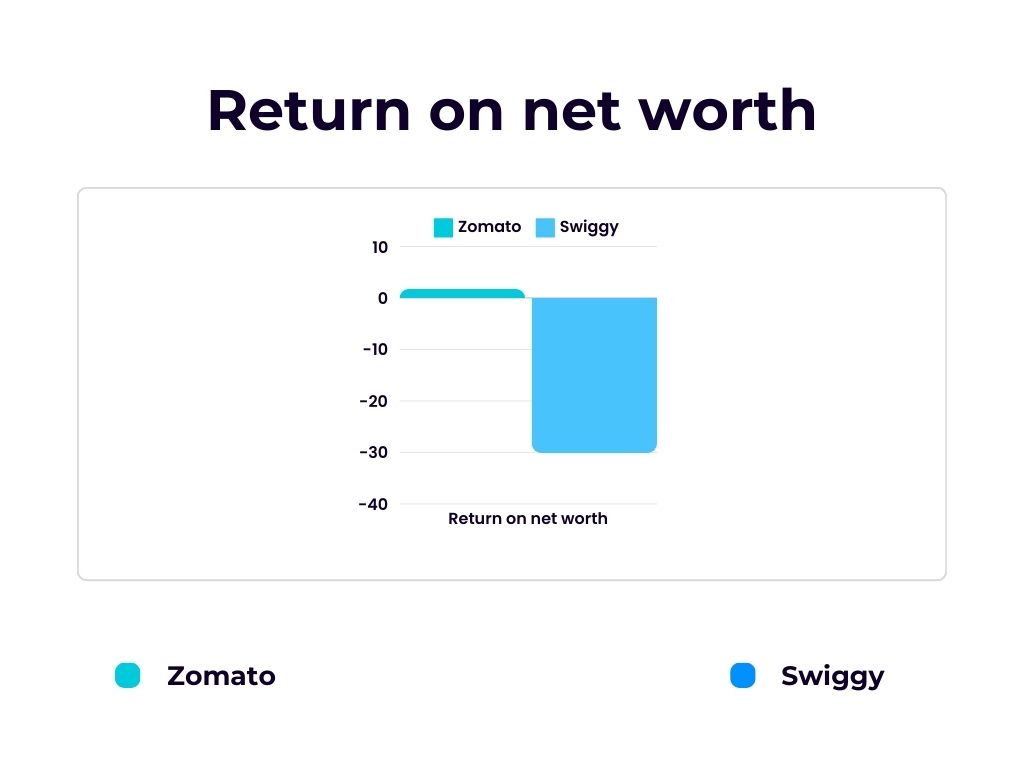

3.2 Return on Net Worth

Swiggy’s Return on Net Worth (RoNW) has improved from -46.15% in FY23 to -30.16% in FY24, indicating that the company is moving toward profitability. In contrast, Zomato’s RoNW stands at +11.72%, making it a more attractive option for some investors.

4. Leadership Challenges and Executive Exodus

One of the biggest concerns for Swiggy moving forward is its recent executive exodus. Several top executives, including the former CTO and VP of Revenue, have left the company over the past year. This raises questions about the stability of Swiggy’s leadership team, which is crucial for executing its growth strategy and adjusting to market conditions.

Without strong and stable leadership, even Swiggy’s clear vision and operational strengths may falter. Investors will need to consider whether Swiggy’s leadership team is prepared to steer the company through the competitive food delivery landscape, especially in the face of Zomato’s rapid expansion and market share gains.

5. IPO Outlook: Risks and Opportunities

Despite the challenges, Swiggy’s IPO presents a significant opportunity for investors looking to tap into India’s growing food and grocery delivery market. Swiggy’s revenue growth, operational efficiency, and super app potential are clear strengths. However, its unproven ability to dominate as a super app, ongoing market share losses, and leadership gaps are risks that cannot be ignored.

The Key Players in Swiggy’s Offer for Sale (OFS)

Swiggy’s IPO involves both an offer for sale (OFS) and a fresh issue of shares. The existing shareholders participating in the OFS include major investors such as Accel India IV (Mauritius) Ltd, Apoletto Asia Ltd, Alpha Wave Ventures, LP, Coatue PE Asia XI LLC, DST EuroAsia V BV, Elevation Capital V Ltd, Inspired Elite Investments Ltd, MIH India Food Holdings BV, Norwest Venture Partners VII-A Mauritius, and Tencent Cloud Europe BV. These shareholders are offering part of their stakes in the company, allowing them to exit or reduce their positions.

Additionally, the company is exploring the possibility of raising funds through a pre-IPO round, which, if successful, could lead to an adjustment in the size of the fresh issue. This pre-IPO round could provide Swiggy with additional capital to enhance its business model and expand its services even further.

Conclusion

Swiggy’s ₹10,000 crore IPO is poised to be a landmark event in India’s tech landscape. The company’s innovative super app model, cost-saving delivery system, and revenue growth present a compelling case for investors. However, leadership stability, market competition, and consumer behaviour towards super apps will be crucial factors that determine Swiggy’s success post-IPO.

Investors should weigh these risks and opportunities carefully as Swiggy sets out on its next phase of growth. Will Swiggy follow Zomato’s path to profitability, or will its super app model struggle in a market favouring specialised apps? Time will tell.

For More details about the Swiggy IPO, you can refer to DRHP Documents.

Your blog has become an indispensable resource for me. I’m always excited to see what new insights you have to offer. Thank you for consistently delivering top-notch content!